As the Great Wealth Transfer accelerates, high-net-worth families face a critical challenge: preparing the NextGen. Discover how family offices can bridge the gap between college life and business ownership with specific succession strategies.

The headlines call it the “Great Wealth Transfer.” Over the next two decades, an estimated $84 trillion will pass from Baby Boomers to Gen X and Millennials. For affluent families, this isn’t just a macroeconomic statistic; it is a deeply personal milestone that carries immense pressure.

As a parent, you have provided your children with the best education money can buy. But a university degree—even an MBA from a top-tier school—rarely prepares a young adult for the specific complexities of managing a family office or taking the helm of a multi-generational business.

The statistics are sobering: 70% of family-owned businesses fail to survive the transition from founder to second generation, and 90% do not make it to the third. This is often due not to a lack of capital, but a lack of preparedness.

How do you ensure your college-aged child falls into the successful 10%? The answer lies in treating their undergraduate years not just as academic exploration, but as a structured apprenticeship in stewardship.

The “Silent” Risk: Why Succession Plans Fail

Many high-net-worth parents hesitate to discuss the full extent of family wealth with their children, fearing it might diminish their drive. A recent study found that 52% of affluent parents have not discussed their net worth with their children, yet 95% of adult children claim they are ready to manage it.

This disconnect creates a dangerous knowledge gap. When heirs step into ownership roles without context, “imposter syndrome” and poor governance often follow.

Shutterstock

The Family Office as a Training Ground

Your family office is more than a wealth management vehicle; it is the most effective educational institution your child will ever attend. Leading family offices are now shifting focus from pure asset allocation to “Human Capital Preservation.”

Here is how you can leverage your family office to prepare your college student for the responsibilities ahead.

4 Strategic Pillars for College-Aged Successors

You do not need to burden your 20-year-old with the weight of the entire empire today. However, you should encourage them to build a “governance resume” alongside their academic one.

1. The “Outside” Rule (The Golden Standard)

Most successful multi-generational families enforce a strict policy: NextGen members must work outside the family business for 3–5 years before they are eligible to join.

- Why it matters: It builds independent self-worth and allows them to make mistakes on someone else’s dime. They return to the family business with external skills and genuine credibility among non-family employees.

- The College Step: Encourage internships at competitors or in completely different industries. If your family made wealth in real estate, suggest they intern in tech or private equity to bring fresh perspectives back to the table.

2. Financial Literacy “Bootcamps”

Economics 101 teaches supply and demand, but it does not teach trust structures, K-1 tax forms, or liquidity management.

- Recommendation: Ask your Chief Investment Officer (CIO) to run a bi-annual “portfolio review” specifically for the NextGen.

- The Curriculum:

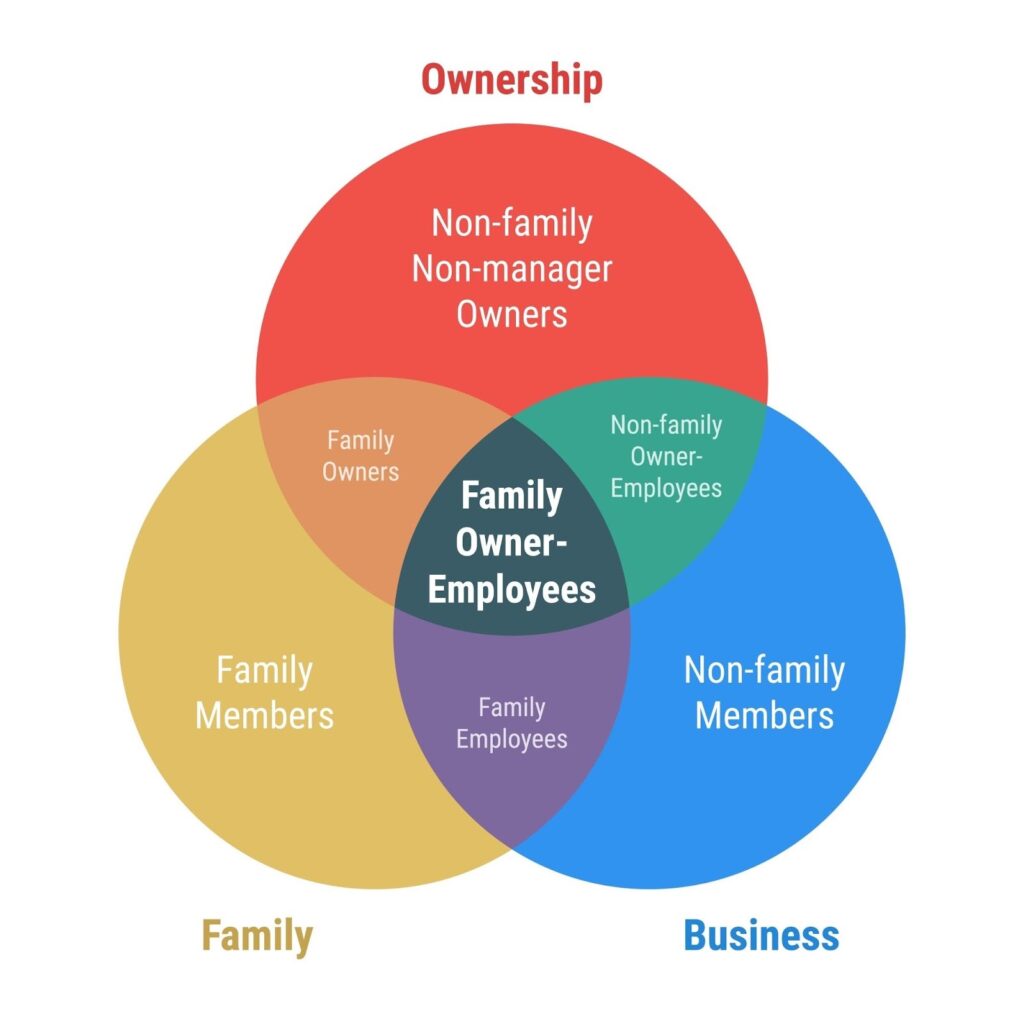

- Understanding the difference between ownership (shareholder) and management (CEO).

- Reading the family balance sheet.

- The basics of philanthropic impact investing (a massive area of interest for Gen Z).

3. The “Junior Board” Seat

Governance is a learned skill. You cannot expect a 30-year-old to be an effective board member if they have never seen a board meeting.

- The Strategy: Create a “Junior Board” or “Observer Seat” on your Family Foundation board.

- The Role: They have no voting rights, but they receive the board packet, attend meetings, and are allocated a small portion of the philanthropic budget to manage collectively. This teaches them how to build consensus, read bylaws, and vote on proposals in a low-risk environment.

4. Codify the “Family Constitution”

Unspoken expectations breed conflict. A Family Constitution is a formal document that outlines the rules of engagement.

- What to include:

- Employment Policy: What are the GPA or degree requirements to enter the business?

- Code of Conduct: How does the family handle public relations and social media privacy?

- Exit Strategy: How can a family member sell their shares if they do not want to be involved?

Pro Tip: Involve your college-aged children in drafting a section of this constitution (e.g., the Philanthropy or Social Media policy). It gives them “skin in the game” regarding the family’s rules.

A Checklist for Break

When your student returns home for break, move the conversation beyond grades. Here is a simple agenda for a “Family Governance Lunch”:

| Topic | Goal | Action Item |

| The “Why” | Share the origin story of the wealth, focusing on values, not just numbers. | Share one story of a major failure/challenge the business overcame. |

| The Map | explain the basic structure (Trusts vs. Operating Company vs. Foundation). | Draw a simple diagram of the family entities. |

| The Future | Ask them what they care about (Sustainability? Tech? Art?). | Identify one area where their interests align with the family portfolio. |

The Hidden Burden: Mental Health, Identity, and “Wealth Fatigue”

While we often focus on the financial mechanics of transfer, the psychological transfer is far more perilous. Wealth—specifically the prospect of inheriting it—can act as a hyper-accelerant for mental health struggles.

Research by psychologist Dr. Suniya Luthar found that adolescents from upper-middle-class and high-net-worth families exhibit rates of depression, anxiety, and substance abuse that are 2 to 3 times higher than national norms.

Understanding “Sudden Wealth Syndrome”

Even if your child has grown up with money, the moment legal ownership transfers (or a trust vests) can trigger a psychological shock known as Sudden Wealth Syndrome (SWS).

- The Symptoms: Guilt about unearned advantages, paranoia that friends only like them for their money, and a paralyzing fear of “losing it all.”

- The Statistic: A study by the Money, Meaning, and Choices Institute suggests that without preparation, wealth inheritors take an average of 1 to 5 years to psychologically adjust to their new status, during which time they are highly vulnerable to predatory influences and behavioral spiraling.

The “Imposter” Trap and Substance Risk

For many NextGen students, the family legacy feels less like a safety net and more like a high-wire act. They often grapple with a deep-seated belief that they can never replicate the founder’s success. This pressure often manifests in “self-medicating” behaviors.

- The Risk: Affluent young adults have access to higher-quality, more concealable substances and the privacy to hide addiction longer than their peers.

- The Trigger: The most dangerous period is often the “Gap of Purpose”—the time after college graduation but before they have established their own professional identity.

Recommendations for Mitigation

- Decouple Worth from Net Worth: Praise effort and character traits (kindness, grit, curiosity) rather than outcomes or status. Ensure they know their place in the family is secure, regardless of whether they join the business.

- Mandatory “Psychological Readiness” Assessment: Just as you audit the business, audit the heir. Before transferring significant assets, have a third-party industrial psychologist assess their emotional maturity and resilience.

- The “Quiet” Trust: Consider structuring trusts that remain “silent” (where the beneficiary does not know the full amount) until the beneficiary reaches a specific age or milestone of maturity, usually past the volatility of the early 20s.

Conclusion

Transferring ownership is a legal event; transferring stewardship is a decades-long process. By utilizing the college years to instill financial fluency, governance experience, and psychological resiliency, you are not just protecting your assets—you are empowering your children to be capable, confident guardians of the family legacy.

Don’t let your heirs be part of the 90% statistic. Start the conversation today.